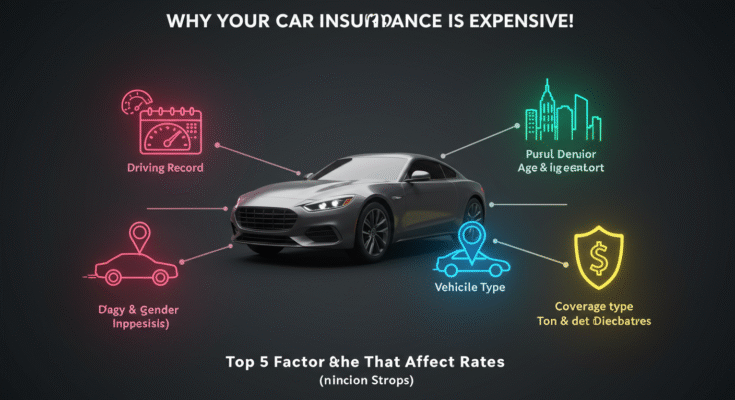

Ever wonder why your neighbor pays less for car insurance than you do? Car insurance companies use dozens of data points to calculate premiums. Understanding these factors will help you find cheap auto insurance rates, qualify for discounts, and avoid unnecessary costs

Factor 1: Driving Record

-

Accidents, speeding tickets, DUIs = higher premiums.

-

Clean driving history = up to 40% cheaper rates.

-

Keywords: safe driver discounts, high-risk auto insurance quotes, affordable auto insurance for good drivers.

Factor 2: Age & Gender

-

Young drivers (under 25) → higher premiums.

-

Seniors (65+) → may qualify for senior discounts.

-

Keywords: cheap auto insurance for young drivers, car insurance discounts for seniors 2025.

Factor 3: Location

-

Urban areas = higher accident/theft rates.

-

States with “no-fault” laws = more expensive.

-

Keywords: Michigan auto insurance rates, cheapest states for car insurance USA.

Factor 4: Type of Vehicle

-

Sports cars = expensive insurance.

-

Family sedans = cheaper.

-

Electric/hybrid cars → sometimes get eco-discounts.

-

Keywords: cheap insurance for hybrid cars, auto insurance rates by car type.

Factor 5: Coverage Type & Deductible

-

Liability-only = lowest cost.

-

Full coverage = higher but more protection.

-

Raising deductible = lower monthly premium.

-

Keywords: liability vs full coverage car insurance, full coverage auto insurance cost.

Bonus Factors That Matter in 2025

-

Credit score (in most states).

-

Annual mileage (low-mileage discounts).

-

Marital status (married drivers often pay less).

How to Lower Your Rates in 2025

-

Compare auto insurance quotes online instantly.

-

Bundle policies (home + auto = discounts).

-

Ask about no down payment auto insurance offers.

FAQs

Q1: Why do teenagers pay more for car insurance?

Teen drivers are statistically more likely to be involved in accidents.

Q2: Can I get cheap auto insurance if I have a DUI?

Yes, some companies specialize in high-risk driver insurance quotes.

Q3: Which state has the cheapest auto insurance in 2025?

Maine, Idaho, and Ohio often rank as the most affordable states.

Conclusion

Your car insurance rates depend on multiple factors, including your driving record, location, age, and type of coverage. By understanding these influences and comparing car insurance quotes online, you can unlock significant savings and choose the best policy for your needs.